Explore the inconceivable trend followed by the importing dependency of India to China. Read further to know about the tendency of trade deficits and exporting of India - China bilateral trade

In recent days, the ongoing debate is associated with exports and imports followed by trade deficits of India - China bilateral trade. China is the leading trade partner of India and contributes around 18% of India's total imports and nearly 9% to India's total exports. Because of this pandemic situation and the cross border tensity, "Boycotting Chinese Products" became a repetitive slogan to all the individuals and media across terrene. Throughout this blog, we will confer about the Exports and Imports of India and also the Trade Deficit concluding with resolving the myth associated with this bilateral trade. Note : Forthcoming charts and visualizations are done using Tableau Visualizing Software.

Import from China

(value in US $)

Starting with the year of 2000 the importing value was 1,283 million USD and the percentage of importing value was around 2.5%. Over the period, the importing value attained it's heights of peak in 2018 with a value of 76,381 million USD and the importing percentage was more than 16%. The reported importing value in 2020 is 62,379 million USD which is brought down around 14,002 million USD when compared to the peak value of import from China to India. But the case is that when we correlate the importing value in 2000 and 2020, the rise percentage proliferated to 4762.41% with increase in value of 61,096 million USD. The imports from China ranges from raw materials to critical components. Some of the imported commodities are :

Auto components

Electronics components

Consumer Durables

Active Pharmaceutical Ingredient (API)

Leather Goods

From this, we can vocalize that India mostly depends on China when it comes to the case of Importing. Read further to know about the Exporting details.

Export from India

(value in US $)

In the year of 2000 the exporting value was around 600 million USD with a percentage of 1.5%. The exporting value reached it's heights of peak in 2012 with a value of 18,077 million USD. The increased value of exporting was 17,407 million USD when compared to 2000. According to the year of 2020, the exporting value is 15,541 million USD with increase in percentage of 5.25%. When correlating the exporting value of 2000 and 2020, the rise percentage zoomed to 2783% with an escalated exporting value of 15,001 million USD. The major commodities which are exported from India are namely :

Gems and Jewellery

Minerals and Ores

Organic Chemicals

Sea Food

Electrical Machinery

Cotton

We can scrutinize that most of the exported commodities are associated with the sector of raw materials and natural resources. We can say that, there is a humongous opportunity for India if it tracks and radars on the sector of Raw materials and Natural resources.

Trade Deficit with China

(value in US $)

At the entry of 2000 the trade deficit was 744 million USD with a percentage around 5%. The growth was gradual until the year of 2006 because of the globalization, the values of trade deficit with China were multiplicative and increased year by year. The values acquired it's peak in the year of 2018 with a rise percentage of 47% along with a rise value of 63,047 million USD. After attaining it's peak the values tend to be declining to say, the values came down to 46,389 USD with a differential value of 16,658 million USD. This massive trade deficits are because of the excessive imports of commodities from China.

Overall Trade Deficit of India

(value in US $)

(value in US $)

This Treemap representation clearly reveals that the Trade Deficit of India was at it's peak on 2013 with 190,336 million USD. As I've mentioned before the Trade Deficit values are massive because of lack in exports and surplus amount of imports. We observe the shift of Trade deficit value in 2020 from red region to orange region in the Treemap. Even though we face a diminish in Trade Deficit values from 2013 to 2020 the values are still high. Among this colossal Trade Deficit the major portion of it is contributed by Petroleum Products and Gold.

(value in US $)

This graph represents the total import of Petroleum products and Gold from 2000 - 2020. In the year 2000 the import value was 16,628 million USD and then gradually came up to a value of 26,902 million USD in 2004. After that, the perspective of values changed to be augmentative and doubled up since 2005. Apart from being multiplicative, there was a phenomenon growth in value between 2010 and 2013 with a peak value of 210,704 million USD in 2013. To give a flavor, the increased importing value between 2010 and 2013 is 95,246 million USD. In 2020 the delineated importing value is 146,247 million USD which is way more less than the peak value. Howbeit, the value plunged from 2013 to 2020 it is still considered as an enormous importing value. So, what happens if we subside the value of Petroleum Products and Gold over time and find an alternative solution? Read further to know about it.

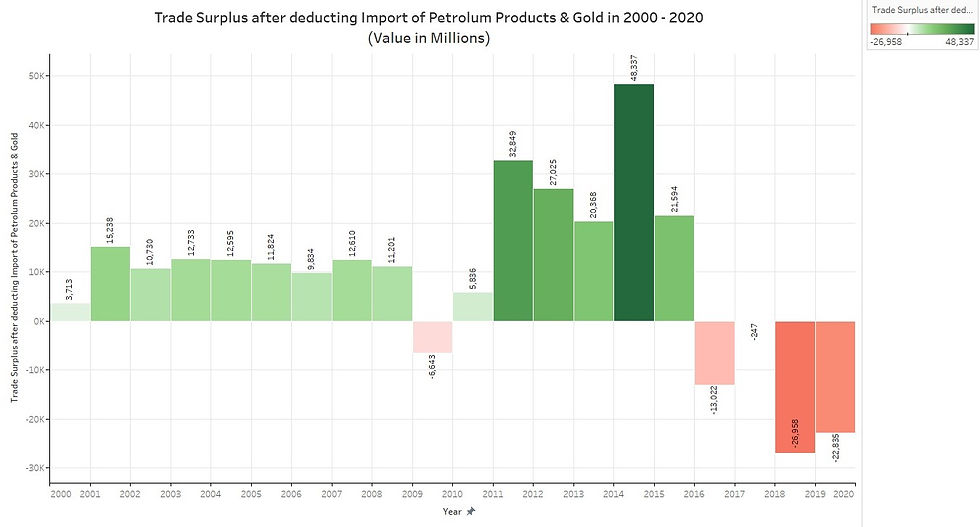

(value in US $)

This Bar Chart exposes the Trade Surplus (exports exceeds the cost of imports) after deducting Petroleum Products and Gold. We can notice that most of years are turned to be Trade Surplus except the recent past. The trend between 2000 - 2015 is most likely to be uprising and touched it's peak in 2014, but the recent trend still reveals a deficit value. Howbeit, on an average the trend is more likely to be in uplifting manner. It is also clear that if we reduce the imports of Petroleum Products and Gold it results in escalation of Trade Surplus of India. This can be done only by taking stringent measures by the government to shift people towards the usage of electric vehicles and encourage the citizenry to invest in stock market rather than investing in gold. By taking these measures it is possible to make phenomenal changes in the Trade Deficit.

(value in US $)

Resolving The Myth

What is the myth associated with this debate? In recent days there are many problems going around, to be precise this pandemic period and the cross border tensity between India - China which contributes to the myth of "Boycott Chinese Products". Apart from current situation and tensity going around, What happens if we Boycott Chinese Products in our Indian market? From the above data and representations it is very clear that India is mostly dependent on China and if India boycotts, our economy would drain to sewage. India can be able to withstand only by taking ideal and optimistic alternatives for the below mentioned imports -

This myth resolving table is very important because it plays a vital role in thinking of the alternative which can be done to reduce the imports. Coming to the case of Chemicals, there are various out performers in Chemical manufacturing in India namely :

Balaji Amines and Alkyl Amines - Alkyl

NOCIL - Rubber chemicals

Himadri Speciality and Philips Carbon - Carbon black

Bhansali Engineering - Engineering plastics

These companies are worth tracking and are beneficiary for the government to reduce the import dependency on the sector of Chemicals. When shifting towards the sector to Raw materials it is worth to radar companies like :

Deepak Nitrite

GNFC

The above two companies focus on producing key raw materials such as Acetone, Phenol, Aniline, Acetic acid and Nitric acid. With the help of these two companies India can reduce it's heavily imported raw materials. In case of Pharma the following companies are key manufacturers of APIs:

Aarti Drugs

Granules India

JB Chemicals

IOB Chemicals

The above mentioned companies also focus in synthesizing drugs such as Paracetamol, Metronidazole, Ibuprofen and also attempts in backward integration. In the consumer durable space, the following companies are worth tracking:

Havells

Voltas

These two companies are conspicuous to the domestic players who manufactures durable goods to diminish import dependencies. Coming to Auto components segment the worth-tracking eminent players includes :

Lumax Industries

Maruti

These companies focus towards setting up an electronic environment for localizing component manufacturing in order to turn down the import dependency.

The above shown companies are the most prominent and viable players in case of exporting who are resilient to the import dependency and also the supply chain is likely to shift, so India has a humongous opportunity to increase it's exports. To emphasize, even if 5% of USA's import from China shifts to India the opportunity size ranges to 140 billion USD. If India focus and counts on these companies it is possible to slash the import dependency on China and capture the export opportunity.

To conclude, this global shift of supply chain is expected to bring right set of circumstances to India and varied response to Indian companies. To Boycott Chinese Products India needs to manage the supply chain risk. To enunciate, the new juncture of Globalization shift towards "reliability" rather than "cost economics". The new phase of Indian vision will be to thrive on self-initiatives and manufacturing, to spotlight the golden vision of India is "AATMA NIRBHAR BHARAT" meaning to localize all business initiatives and manufacturing to pare the import dependency on China. We may also scrutinize enormous efforts taken by various sectors to implement backward integration in India. Along with that India is about to witness colossal opportunities as the global supply chain diversifies. To resolve the myth let's dedicate our work towards the accomplishment of "AATMA NIRBHAR BHARAT" to "BOYCOTT CHINESE PRODUCTS".

In this day of “discard Chinese goods “slogan being said as a mantra ,by each and every body, even the other day the Street vendor was quoting this slogan, as a matter of his routine, Without even knowing the impact on the country, Nikil has done an in-depth analysis on this very important subject. His graphical presentation, on the sector wise imports from China and on the exports, is excellent in its content and use. His suggestion for self dependence, the various alternatives available within India can be useful to industrial units and traders.Good initiative at the present juncture keep it up.

Nice work Nikhil. Keep it up.

Good work Nikhil!

A few other points. Trade is a two-way street. Boycotting Chinese imports could also mean a drop in Indian exports to China. India (if it pursues this for nationalistic reasons) would have to source imports from other countries in the near term as building domestic supply chains would take time. Inherent structural problems (labour, capital, infrastructure) could be why India had to import in the first place and should be solved to foster domestic supply.

Good Analytic by Little Genius

Nice.. Keep it up